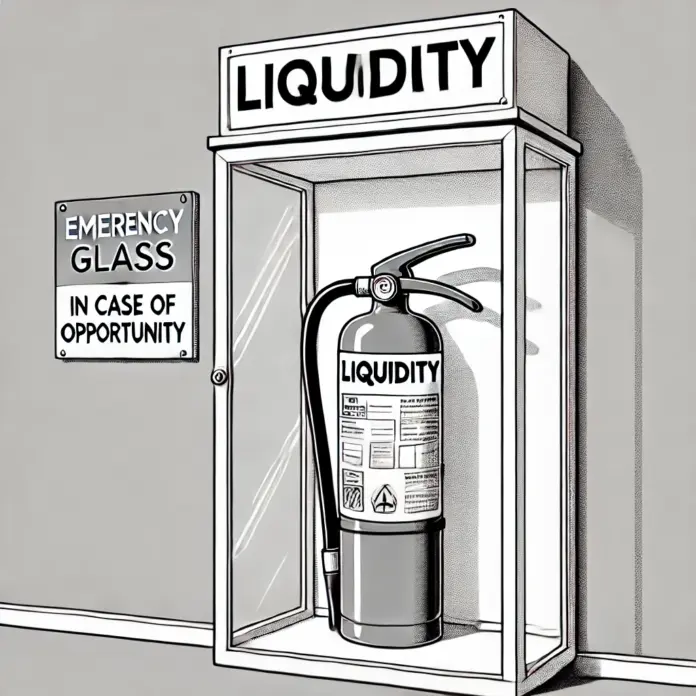

You’re sitting on a pile of wealth—real estate, stocks, a business—but when a crisis hits or an opportunity knocks, it’s useless if you can’t access it fast. A frozen fortune is as good as none. The wealthy don’t let their money get stuck; they use a liquid wealth strategy to keep cash free, fast, and flexible, ready to seize deals or weather storms. This isn’t about hoarding cash in a low-yield account—it’s about structuring assets for instant access without selling your empire or bleeding taxes. Here’s how millionaires ensure liquidity is life and how you can make your wealth flow like water.

Liquidity’s your lifeline. A market crash, a lawsuit, or a once-in-a-lifetime deal doesn’t wait for you to sell a property or liquidate stocks. Without cash access, you’re stuck—forced to sell at a loss or miss the chance. Savings accounts seem liquid but lose 3% yearly to inflation; a $100,000 balance shrinks to $82,000 in real value over a decade. The rich keep wealth liquid through strategic tools—refinancing, lines of credit, IULs, and syndications—that unlock cash without dismantling their portfolio. One client faced a $200,000 medical emergency; his liquid strategy let him tap $250,000 in hours, no sales or taxes. Liquidity isn’t just convenience—it’s survival.

Real estate’s a liquidity killer unless you play it smart. A $500,000 property’s equity is trapped until you sell, eating 20% in capital gains taxes. Instead, refinance to pull $150,000 tax-free, keeping the property’s income and growth. A guy I know refinanced his rental, took $100,000, and invested in a syndication netting 10%—$10,000 yearly passive—while his property appreciated. Or use a home equity line of credit (HELOC) for instant access; at 6% interest, it’s cheaper than selling. Another client’s $200,000 HELOC funded a business deal, repaid by profits, no assets sold. These moves keep your wealth fluid, not frozen in bricks.

Indexed universal life (IUL) policies are a secret weapon. Fund one with $20,000 yearly; the cash value grows tax-deferred, and you can borrow tax-free anytime. A client funded an IUL with $50,000 over five years, borrowed $75,000 tax-free for a real estate deal, and kept his cash growing at 6%. His heirs get a $3 million tax-free death benefit. Unlike a 401(k), which locks funds until 59½ with penalties, IULs offer access without tax hits. Pair it with a trust for creditor protection, and your liquidity’s bulletproof. One woman’s IUL loan covered a $100,000 opportunity in days, no IRS penalty.

Syndications add flexibility without management. Instead of tying up $300,000 in one rental, invest $50,000 in a syndicated apartment complex, yielding 8–12% and depreciation deductions. You’re not selling assets or chasing tenants—just collecting checks. A client’s $80,000 syndication stake nets $7,000 yearly, liquid enough to exit in 3–5 years. Or try private lending: lend $100,000 at 10%, secured by property, earning $10,000 annually with cash callable if needed. These keep your wealth accessible, not stuck in a single asset.

Taxes can choke liquidity, but the rich play defense. Refinancing avoids capital gains; IUL loans dodge income taxes. Syndications deduct depreciation, sometimes zeroing out taxable income. A client’s $150,000 syndication cut his tax bill by $10,000 yearly. LLCs holding assets let you gift shares under the $18,000 annual exclusion, shrinking your taxable estate while keeping control. A family gifted $1.5 million in LLC shares, staying liquid and tax-free. Compare that to selling a stock portfolio, losing 20% to taxes, and waiting weeks for funds.

Liquidity strategies carry risks—HELOCs need repayment, syndications can lock funds, and IULs require consistent premiums. Bad deals or markets can bite. You need a team—CPA, lawyer, financial strategist—to vet investments and structure tax plays. One client dodged a shady syndication by checking the operator’s history; his next deal netted 9%. Stress-test cash flow, keep reserves, and review annually. The payoff? Wealth that moves when you need it. A business owner tapped $300,000 from a HELOC and IUL to buy a competitor, doubling his revenue, no assets sold.

The mindset shift’s crucial: wealth isn’t what you own—it’s what you can use. Stop locking money in rigid assets. See liquidity as life. Start small: refinance $25,000 from a property for a syndication at 7%. Or meet a CPA about IULs for tax-free access. There’s a free wealth leverage checkup out there—grab it, run your numbers, and see where your wealth’s stuck. The rich don’t wait for crises or opportunities—they’re ready. Build a liquid wealth strategy, and make your money flow like a river, not a rock.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.