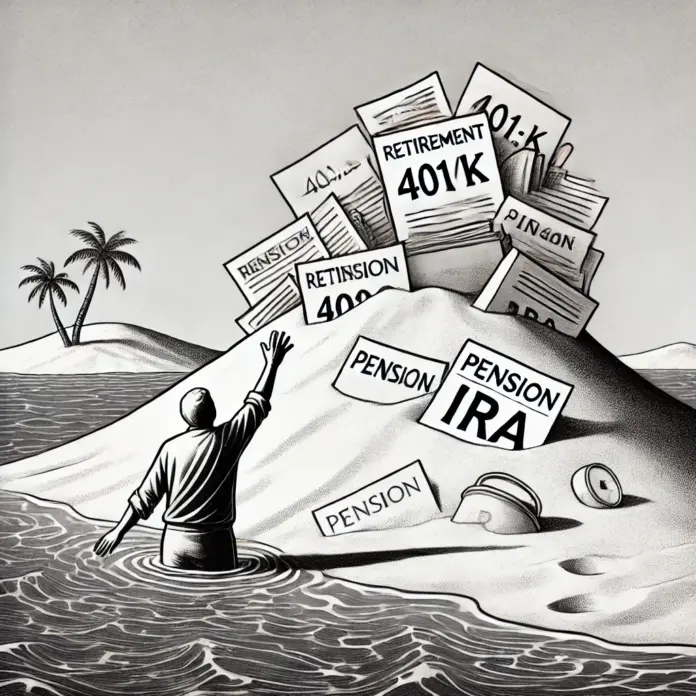

You’ve been sold a retirement dream—golden years of freedom, sipping margaritas on a beach, all thanks to your 401(k) or IRA. But when you reach for that cash, it’s like grabbing at a mirage: your money’s there, but it’s locked away, frozen by rules, taxes, and penalties. Traditional plans promise security but strangle your liquidity, leaving you asset-rich and cash-poor. The wealthy don’t fall for this trap. They master liquid retirement planning, keeping their funds available, growing, and shielded from the IRS’s bite. This isn’t about waiting till 65 to live—it’s about building wealth you can tap now and later, without begging for your own money.

Traditional retirement plans are like a vault with a time lock. You pour in cash, watch it grow (minus fees), but you can’t touch it until 59½ without penalties that sting like a scorpion. Need funds for a business deal or a medical curveball? Too bad—your 401(k)’s a paperweight. Even worse, withdrawals are taxed as income, and required minimum distributions (RMDs) kick in at 73, forcing you to pull cash whether you need it or not. Inflation’s eating your gains, and the stock market’s rollercoaster could tank your balance right when you retire. The middle class buys this “security” hook, line, and sinker, while the elite are out there keeping their wealth fluid and flexible.

Liquidity’s the name of the game—having cash on hand without sacrificing growth. The wealthy use wealth leverage tools that keep their money working and accessible. Take real estate: instead of locking $100,000 in an IRA, allocate $20,000 to a rental property. Tenants pay the mortgage, you pocket cash flow, and the asset appreciates. Need cash? Refinance or sell—no age restrictions, no penalties. One client bought a triplex with $40,000 down, now pulls $1,500 a month passive, and can tap equity anytime. Compare that to a 401(k), where your money’s held hostage and taxed when you finally get it.

Then there’s the indexed universal life (IUL), a favorite among the savvy. Fund an IUL, let the cash value grow tax-deferred, tied to market indexes without the downside risk. Need liquidity? Borrow against it tax-free, no questions asked, while your cash keeps compounding. A guy I know max-funded an IUL with $25,000 a year, borrowed $50,000 for a real estate deal, and his cash value didn’t skip a beat. The death benefit’s a bonus, passing tax-free to heirs. Unlike your IRA, an IUL doesn’t lock your money or force withdrawals—it’s a liquid retirement planning machine that scales with your hustle.

The tax angle’s where traditional plans really crumble. You defer taxes now, but withdrawals are taxed as income—rates could be higher in 20 years. The wealthy hedge with tax-advantaged growth. Real estate offers deductions—mortgage interest, depreciation—that slash your taxable income while your wealth grows. Or use an LLC to funnel business profits, deferring taxes or shifting income. Pair an IUL with a trust, and you’ve got a legacy play: tax-free growth, tax-free access, tax-free transfer. One client’s trust holds IUL proceeds, funding his kids’ future without estate taxes. Traditional plans? They’re a tax trap, bleeding you when you’re old and gray.

But liquidity isn’t a free pass. Real estate can slump, IULs need careful management, and bad deals can burn. You need a plan—market research, a financial pro, maybe a lawyer for trusts. The payoff? Wealth that’s yours to use, not a mirage you chase. The rich don’t wait for retirement to live; they build liquid wealth that flows now and later. Think of it like a river: traditional plans dam your cash; liquid planning keeps it moving. You can too. There’s a free wealth leverage checkup out there—grab it, run your numbers, and see where your retirement’s drying up. Stop chasing the mirage. Build wealth you can touch, today and tomorrow.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.