Death comes for us all, but the taxman doesn’t have to come for your wealth. Estate planning isn’t about picking out a coffin—it’s about outsmarting the IRS so your heirs inherit an empire, not a tax bill. The wealthy don’t just write wills; they build fortresses with trusts, LLCs, and slick wealth transfer strategies that make estate tax avoidance a high art. While you’re fretting over who gets grandma’s ring, the elite are shielding millions from Uncle Sam’s claws, ensuring their legacy flows untouched. This isn’t about dying—it’s about dodging, and playing the game sharp enough to keep your wealth alive for generations.

The IRS is a vulture, circling estates worth over $13.6 million in 2025, ready to snatch up to 40% in taxes. That’s not pocket change—it’s a wrecking ball for families with real estate, businesses, or hefty portfolios. Most folks think a will’s enough, but it’s like bringing a butter knife to a gunfight. Probate’s a public mess, dragging your assets through court, airing your wealth for all to see, and inviting tax hits that gut your legacy. The rich don’t play that game. They use estate tax avoidance tools—legal, layered, and so clever they make the taxman look like he’s chasing his own tail.

Start with trusts, the backbone of any dynasty. A revocable living trust lets you control your assets while you’re alive, then passes them to your heirs without probate’s chaos—no court, no delays, no public record. Want to go harder? Irrevocable trusts, like dynasty trusts, shield wealth from estate taxes, creditors, or your kid’s bad divorce. One client set up a trust that pays his grandkids’ college tuition tax-free, while the principal grows untouched for decades. That’s not a will; that’s a legacy engine. Pair it with a gifting strategy—$18,000 per person annually, no tax hit—and you’re moving wealth to your heirs while shrinking your taxable estate. The IRS hates it, but it’s legal as a sunrise.

LLCs are another weapon. Got a business or rental properties? Park them in an LLC to protect your personal wealth from lawsuits. Then gift LLC shares to your heirs over time, under the gift tax exclusion. Your business grows, but its taxable value stays frozen, dodging estate taxes. One sharp move: a real estate mogul gifted LLC interests to his kids, cutting his estate’s tax exposure while keeping control. Or consider a family limited partnership (FLP)—pool assets like real estate or investments, control them as the general partner, and gift limited shares to your heirs at a discount. It’s like handing over wealth without losing the reins, all while the taxman’s left empty-handed.

The slickest play? Private financial structures, like indexed universal life (IUL), that double as tax-advantaged growth machines. Fund an IUL, let the cash value grow tax-deferred, borrow against it tax-free for investments, and pass a tax-free death benefit to your heirs. It’s not insurance—it’s a wealth leverage tool that sidesteps estate taxes entirely. One client max-funded an IUL, borrowed $100,000 for a business deal, and kept his cash value compounding. When he passes, his kids get millions, tax-free. Compare that to a will, where your estate’s carved up in court and taxed to death.

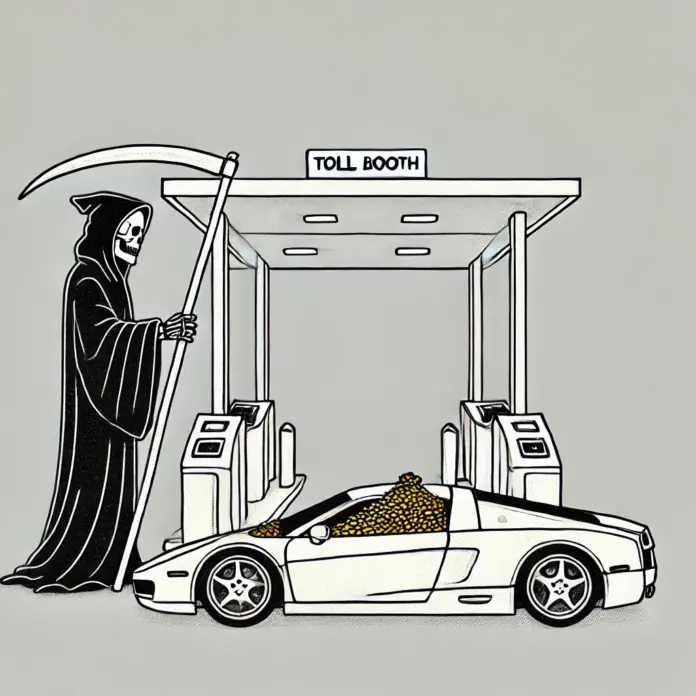

But these moves aren’t plug-and-play. Mess up the paperwork or skip a step, and you’re exposed—creditors, lawsuits, or the IRS could pounce. You need a team: a lawyer who speaks dynasty, not divorce, and a financial pro who knows tax-smart strategies. The payoff? Your wealth skips the taxman’s toll booth, flowing to your heirs like a river. The wealthy don’t leave their legacy to chance—they engineer it. You can too. There’s a free wealth leverage checkup out there—grab it, map your fortress, and make sure your empire outlives you, not the IRS.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.