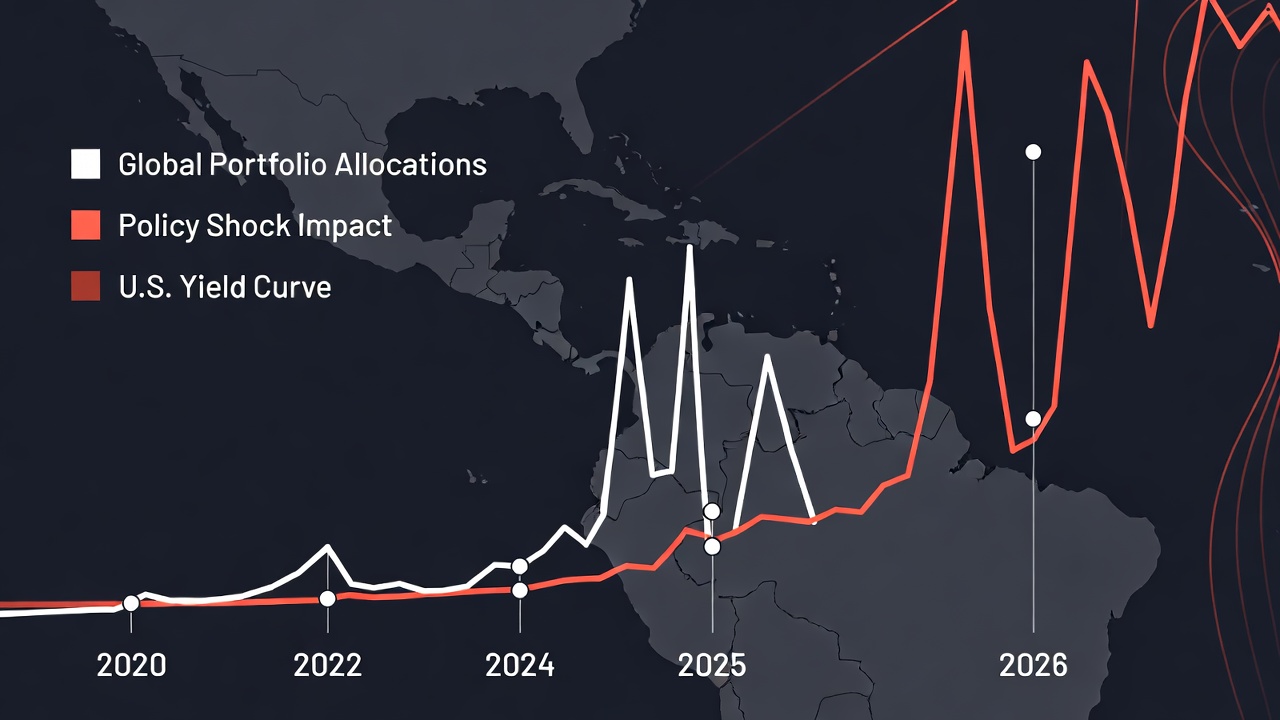

Global portfolio allocations to LatAm sovereign debt have climbed to multi-year highs, surpassing the 2023 peak levels as firm U.S. Treasury yields continue to underpin inflows into emerging market fixed income. This extended positioning, concentrated heavily in Brazilian and Mexican sovereign bonds, reflects sustained investor confidence in regional fundamentals such as declining inflation, resilient commodity exports, and relatively accommodative domestic monetary policies.

However, the resulting crowded trade now leaves South Florida-based family offices and cross-border allocators exposed to amplified volatility from fundamental shocks—including domestic political developments, foreign exchange pressures, and evolving U.S.–Latin America bilateral relations—rather than conventional valuation-driven repricing.

IDB Capital Increase Act Reshapes LATAM Capital Flow

Global Allocations Surge Beyond 2023 Peaks

Global portfolio allocations to Latin American sovereign bonds have risen to multi-year highs. Positions now exceed 2023 peaks. Firm U.S. yield dynamics support the extension. BNY data indicate broad inflows into LatAm equities, bonds, and FX over recent months. Sovereign holdings stand elevated relative to other emerging markets.

In November 2025, Latin American sovereign holdings reached about 15% above the rolling 12-month average. Emerging markets overall fell below benchmark. By early February 2026, global EM holdings remained below benchmark. Latin American fixed income held about 10% higher. Adjustments began first in FX. Every market except Peru saw net buys on a quarterly basis across sovereign and corporate bonds.

This shift reflects resilient exports, falling inflation, and accommodative monetary policy in 2025. These factors persist into 2026. EM debt outperformed public bond markets last year. Expectations favor continued exposure increases despite moderated returns.

Crowded Trade Dynamics in LatAm Fixed Income

Extended positioning creates a crowded trade in LatAm fixed income. Wealthy allocators face heightened sensitivity to fundamental shocks. Domestic politics, FX stress, and U.S.–LatAm relations dominate over valuation repricing. Risk stems from event-driven moves rather than gradual spread tightening.

Crowded LatAm sovereigns shift focus to fundamentals. Clear merits exist for re-rating. EM risk-adjusted returns face scrutiny. Positioning leaves limited room for error. Inflows concentrate in sovereign bonds. This amplifies vulnerability to reversals.

Key Facts on Positioning and Flows

- Global allocations to LatAm sovereign bonds exceed 2023 peaks, reaching multi-year highs per BNY EMEA Macro Strategist data as of February 2026.

- Latin American sovereign holdings rose to 15% above the rolling 12-month average in November 2025, widening the gap versus broader EM under benchmark.

- By early February 2026, LatAm fixed income positioning held approximately 10% higher than benchmark, with sovereign bonds leading inflows.

- Net buys occurred quarterly in every LatAm market except Peru across sovereign and corporate bonds in late 2025–early 2026.

- EMB local currency exposure increased to around 55% in recent adjustments, with carry at 6.3%, yield to worst at 7.6%, and duration near benchmark at 5.5.

- LatAm corporates in utilities, metals & mining offer value relative to global BBB-rated peers, supporting selective high-quality exposures.

Fundamental Shock Sensitivity Over Valuation Repricing

Crowded allocations heighten exposure to shocks. Domestic political developments trigger outsized moves. FX volatility amplifies losses in local currency positions. U.S.–LatAm relations, including trade policy and geopolitical shifts, exert direct pressure.

Venezuela regime changes and potential debt restructuring discussions influence regional sentiment. Colombia and neighbors face spillover. Brazil and Mexico attract scrutiny from fiscal and electoral cycles. Consensus projects regional GDP growth at 2.1% for 2026. Divergence appears across countries.

Risk Management Pivot Required

Risk management shifts to rate-directional hedges. Credit differentiation gains priority. Brazil and Mexico exposures carry pronounced duration and policy risks. Brazil faces presidential elections. Fiscal adjustments remain possible. Mexico contends with trade uncertainties and policy consolidation post-election.

Local currency bonds benefit from potential easing. Fundamentals support selective opportunities. High-quality segments favor corporate bonds over pure sovereign duration extension. Maintain interest-rate sensitivity alignment. Avoid large long-end additions.

Institutional operators prioritize structural advantage through jurisdictional arbitrage. South Florida allocators monitor capital flight triggers closely. Asset protection strategies incorporate rate hedges against U.S. yield firmness.

Positioning reflects secular improvements in EM policy credibility. Fundamentals appear more durable than cyclical. Yields retain attraction for long-horizon portfolios. Tactical adjustments counter crowded dynamics.