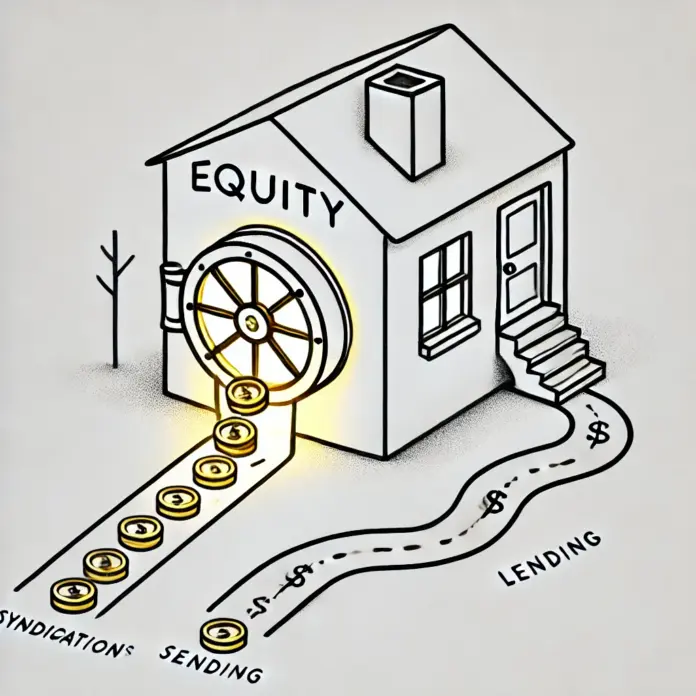

You’ve poured money into real estate, expecting it to be your golden ticket to retirement. Properties stack up, values climb, and you’re dreaming of a cushy future. But real estate’s not a pension—it’s a power play that locks your wealth in bricks unless you know how to unlock it. The wealthy don’t sit on equity, waiting to sell or manage tenants forever; they use a real estate equity strategy to turn properties into liquid wealth, tax-smart income, and legacy assets without being chained to landlord life. Here’s why real estate alone won’t fund your retirement and how to make it a wealth machine instead.

Real estate’s seductive: buy a $300,000 rental, watch it grow to $450,000, collect $1,500 monthly rent. But it’s not a retirement plan. Equity’s trapped until you sell, and selling triggers capital gains taxes—up to 20% federally, plus state taxes. Keep renting? You’re a landlord into your 70s, dealing with leaky pipes and late tenants. A client owned three rentals worth $900,000 but was cash-poor, working overtime to cover repairs. Relying on appreciation or rent’s a trap—your wealth’s stuck, not flowing. The rich don’t wait for a sale; they extract equity now, tax-smart, and keep assets working.

One killer move: real estate syndications. Instead of selling your $300,000 property and eating a $50,000 tax hit, refinance to pull $100,000 tax-free and invest in a syndication—a pooled fund for big projects like apartment complexes. Syndications deliver 8–12% annual returns, plus depreciation deductions that offset taxes. A guy I know refinanced his rental, invested $80,000 in a syndication, and now nets $7,000 yearly passive, no tenant calls. His original property still appreciates, and he’s not managing toilets. Syndications spread risk across larger assets, unlike solo rentals that crash if a tenant bails.

Sale-leasebacks are another gem. Own a commercial property or rental? Sell it for $500,000, lease it back to keep using or renting it, and reinvest the cash. You’re liquid, deduct lease payments as expenses, and dodge capital gains if structured right, like through a trust. A business owner sold his $1.2 million office, leased it back, and used the cash to buy two rentals netting $2,500 monthly. He’s not locked into one property’s risks or taxes. For homeowners, a variation—selling to a family trust you control and leasing back—can work, but needs a sharp lawyer to avoid IRS flags. This is equity flowing, not frozen.

Private lending’s a stealth play. Refinance your property to pull $100,000, then lend it to a developer at 10%, earning $10,000 yearly, secured by their property. You’re not selling or landlording—just collecting checks. One client lent $150,000 from her home equity, netting $15,000 annually while her house appreciated. Pair this with an indexed universal life (IUL): fund it with equity cash, grow tax-deferred, borrow tax-free for more deals, and pass a tax-free death benefit. A guy used $50,000 from a refinance to fund an IUL, borrowed $75,000 tax-free for a syndication, and secured $3 million for his heirs. That’s not a pension—it’s a dynasty.

Taxes are where these strategies shine. Selling a property hits you with capital gains; refinancing or lending avoids that. Syndications offer depreciation deductions, sometimes zeroing out taxable income. A client’s $100,000 syndication stake cut his tax bill by $8,000 yearly via depreciation. Leasebacks deduct payments, and IULs dodge income and estate taxes. Compare that to a 401(k) or savings, taxed as income or losing to inflation. The rich don’t let equity sit taxable—they make it work tax-smart.

But these plays aren’t risk-free. Syndications can lock funds for years; bad tenants or markets can tank leasebacks; lending needs vetted borrowers. You need a team—CPA, lawyer, financial strategist—to structure deals and dodge pitfalls. One client avoided a shady syndication by checking the operator’s track record; his next deal netted 10% annually. Research markets, stress-test cash flow, and keep reserves. The payoff? Wealth that’s liquid, growing, and tax-efficient. A woman refinanced $200,000 from rentals, invested in syndications and lending, and now earns $18,000 yearly passive, her properties still growing.

The mindset shift’s crucial: real estate’s not a retirement plan—it’s a tool. Stop banking on appreciation or rent forever. See equity as a lever to pull now. Start small: refinance $20,000 from a property, try a small syndication at 7%. Or meet a CPA about tax-advantaged lending. There’s a free wealth leverage checkup out there—grab it, run your numbers, and see where your equity’s stuck. The rich don’t wait for retirement to cash out; they unlock real estate equity strategies to live rich now and later. Stop landlording your future. Make your properties a wealth machine.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.