You’ve been taught to fear debt like it’s a venomous snake, ready to sink your finances with one bite. Pay it off, avoid it, live debt-free—that’s the mantra drilled into you. But the wealthy? They don’t run from debt; they wield it like a master swordsman, turning liabilities into rocket fuel for their net worth. Strategic debt leverage isn’t about reckless borrowing—it’s about using debt as a calculated tool to buy assets, multiply cash flow, and dodge taxes, all while the average Joe’s stuck paying off a car loan that’s worth less than his coffee habit. Here’s how the elite transform debt into an asset, and how you can, too, to build wealth that soars.

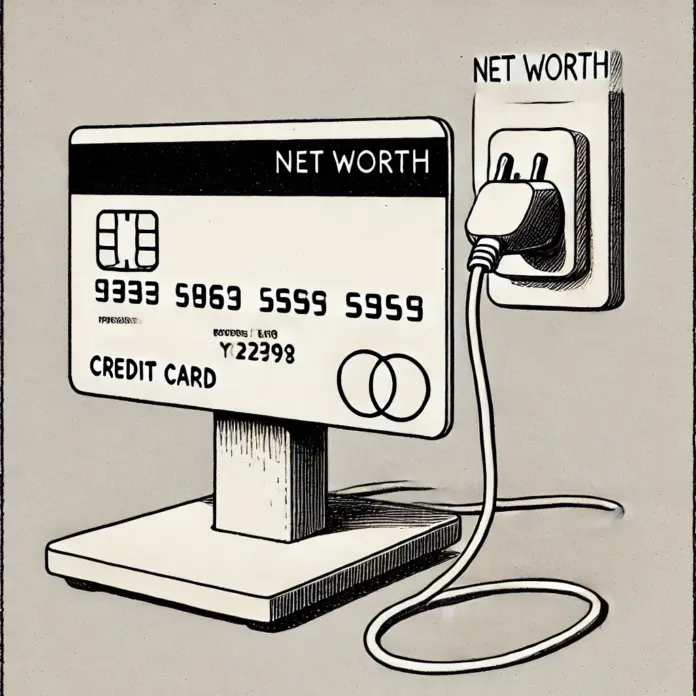

Debt’s not the enemy; dumb debt is. Credit card balances at 20% interest for a new TV? That’s a wealth killer. But debt used to buy appreciating assets or generate cash flow? That’s a game-changer. The rich know this, using strategic debt leverage to amplify their returns without draining their wallets. Take real estate: instead of saving $200,000 to buy a rental property outright, they borrow $160,000 at 5% with a $40,000 down payment. Tenants pay rent that covers the mortgage, taxes, and then some—say, $1,200 a month in profit. The property appreciates over time, maybe hitting $300,000 in a decade, while the debt’s paid down by someone else’s money. One investor I know started with one rental, leveraged it into a portfolio, and now pulls $10,000 monthly passive income. That’s debt working harder than most people’s 9-to-5s.

The magic lies in the math—leverage amplifies returns. Say you buy that $200,000 property in cash, and it grows 5% annually to $265,000 in five years. Your return? 32.5%, or about $65,000. Not bad. Now, use leverage: $40,000 down, borrow $160,000. The same 5% growth nets you $100,000 in equity growth (minus interest, say $20,000), plus $1,200 monthly cash flow ($72,000 over five years). Your return on that $40,000? Over 200%, factoring in cash flow and equity. The rich don’t tie up their cash; they borrow strategically to multiply it. One client leveraged a $50,000 home equity loan into a $250,000 commercial property, now netting $15,000 a year in rent. Debt didn’t bury him—it built his empire.

Business debt’s another weapon. Instead of bootstrapping a startup with your savings, borrow to scale faster. A restaurateur I know took a $100,000 business loan at 6% to open a second location. The new spot’s profits cover the loan and generate $20,000 yearly net. She didn’t drain her savings; she used debt to double her business’s value. Or consider private lending: borrow $50,000 at 5% and lend it out at 10% to a real estate developer. You pocket the 5% spread—$2,500 a year—while your loan’s secured by the property. The wealthy use debt to create cash flow engines, not to buy liabilities that sink them.

Taxes make strategic debt leverage even sweeter. Interest on investment debt—like a mortgage for a rental or a business loan—is often tax-deductible, slashing your taxable income. A real estate investor borrowing $200,000 at 5% pays $10,000 yearly in interest but deducts it, saving $3,700 if they’re in a 37% tax bracket. Pair that with depreciation deductions, and your rental’s profits might be nearly tax-free. Compare that to paying off consumer debt with after-tax dollars—your credit card doesn’t give you a tax break, but a mortgage on an investment property does. One client used a $150,000 loan to buy a multi-family unit, deducted $7,000 in interest yearly, and cut his tax bill by $2,500 while pocketing rent. Debt became his tax shield and his cash cow.

But debt’s not a toy. Misjudge a deal, over-leverage, or skip due diligence, and you’re in trouble. Markets dip, tenants flake, or interest rates spike—risk is real. The wealthy mitigate this with a plan: they research markets, vet properties or businesses, and lean on pros like financial advisors or CPAs. They ensure cash flow covers debt payments and keep reserves for surprises. One guy borrowed $300,000 for a strip mall, but his leases guaranteed rent 1.5 times the mortgage, protecting him from vacancies. Strategic debt leverage demands discipline, not daring.

The mindset shift is critical. Stop seeing debt as a burden and start seeing it as a lever. The rich don’t fear borrowing—they fear missing opportunities. Instead of paying off a low-interest mortgage, they invest that cash in assets that outpace the loan’s cost. One woman kept her 3% mortgage, invested $100,000 in a real estate syndication at 8%, and nets $5,000 yearly after loan interest. Her debt’s an asset, not a chain. You don’t need millions to start—$10,000 can be a down payment on a small rental or a private lending deal. The key? Give your debt a purpose: buy assets that grow, generate income, or save taxes.

Start small to rewire your brain. List your debts—credit cards, car loans, mortgages—and identify one you could redirect. Got a $20,000 savings account earning 0.5%? Use it to leverage a $100,000 rental instead of paying off a 3% student loan. Read up on tax-deductible debt or talk to a financial pro about IULs, which let you borrow tax-free against cash value for investments. There’s a free wealth leverage checkup out there—grab it, run your numbers, and see where dumb debt’s draining you. The wealthy don’t avoid debt; they weaponize it to build empires. You can too. Stop fearing the snake—make it your rocket fuel, and watch your net worth soar.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.