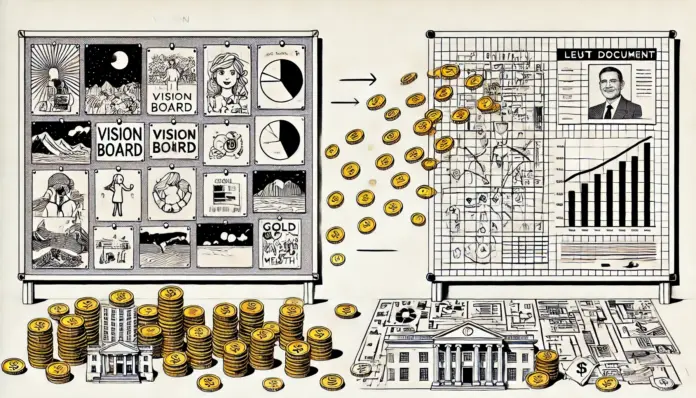

You’re staring at a vision board, chanting affirmations, hoping wealth will materialize like a cosmic Amazon delivery. Spoiler: it won’t. Wealth isn’t woo-woo—it’s built on a financial responsibility mindset, rooted in structure, strategy, and the grit to do what others dodge. The rich don’t manifest trust funds; they engineer them with discipline, tax-smart plays, and moves that outlast wishful thinking. While you’re visualizing a yacht, the elite are structuring LLCs, trusts, and passive income streams that make money work harder than any mantra. Here’s the mindset shift the wealthy inherit early—and how you can adopt it to build a legacy that’s real, not a daydream.

Manifestation’s a cute story, but it’s financial quicksand. Pinning hopes on “positive vibes” keeps you stuck, avoiding the hard work of wealth-building. The rich don’t wait for the universe to deliver; they take responsibility, treating money like a machine to be engineered, not a miracle to be wished for. Their mindset? Every dollar has a job—grow, shield, or multiply. They’re not cutting out lattes; they’re allocating $20,000 to a rental property that spits out $500 a month passive. One client ditched the vision board, put $15,000 into a duplex, and now nets $800 monthly while the property appreciates. That’s not manifesting—that’s math.

The financial responsibility mindset starts with ownership. You’re not a victim of “the economy” or “bad luck.” The wealthy see opportunities where others see obstacles. Take real estate: while you’re praying for a raise, they’re buying distressed properties in a downturn, knowing rents will flow when the market turns. Or they’re using tax-advantaged vehicles like indexed universal life (IUL). Fund an IUL, grow cash tax-deferred, borrow tax-free for deals, and pass a tax-free death benefit to heirs. A guy I know allocated $25,000 yearly to an IUL, borrowed $50,000 for a business, and kept his cash compounding. The universe didn’t hand him that—his strategy did.

Taxes are where the mindset shines. Dreamers pay the IRS without a fight; the rich play chess with the tax code. They use LLCs to deduct business expenses or shift income to lower brackets. Real estate’s a goldmine—deduct mortgage interest and depreciation to cut taxes while building wealth. Or set up a trust to gift $18,000 per heir annually, shrinking your taxable estate. One family allocated $100,000 to a dynasty trust, growing it tax-free for their grandkids while dodging estate taxes. That’s not visualization—it’s a financial responsibility mindset that plans decades ahead, not days.

But this mindset isn’t magic. It demands work—researching markets, vetting deals, building a team of pros like financial advisors or tax lawyers. Mistakes hurt; bad investments or sloppy trusts can backfire. The payoff? Wealth that scales without your constant hustle. The rich don’t dream of trust funds; they build them, brick by brick, with discipline others won’t match. One client swapped affirmations for action, investing $30,000 in a private lending deal at 9%, netting $2,700 yearly passive. He’s not manifesting—he’s executing.

The shift starts small. Ditch one woo-woo habit—like scrolling vision board inspo—and replace it with a real move: read about tax-smart strategies, talk to a mentor who’s built wealth, or calculate a rental’s cash flow. The wealthy inherit this mindset early, but you can adopt it now. It’s not about luck; it’s about responsibility—owning your financial future with strategy, not vibes. There’s a free wealth leverage checkup out there—grab it, run your numbers, and see where your “manifesting” is falling flat. Stop chasing woo-woo. Build a trust fund with a financial responsibility mindset, and let your wealth grow like the elite.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.