You’re pumping every spare dollar into your 401(k), feeling like a financial rockstar, but you’re really just locking your money in a gilded cage. Maxing out might seem like a win—$23,000 a year in 2025, tax-deferred, growing for retirement—but it’s a slow, rigid play that ties up your cash and leaves you vulnerable to taxes, fees, and market whims. The wealthy don’t obsess over 401(k)s; they use 401(k) alternatives that offer flexibility, liquidity, and tax-smart growth. This isn’t about ditching retirement planning—it’s about building wealth you can access, control, and pass on without jumping through IRS hoops. Here’s why maxing out your 401(k) is a trap and what to do instead.

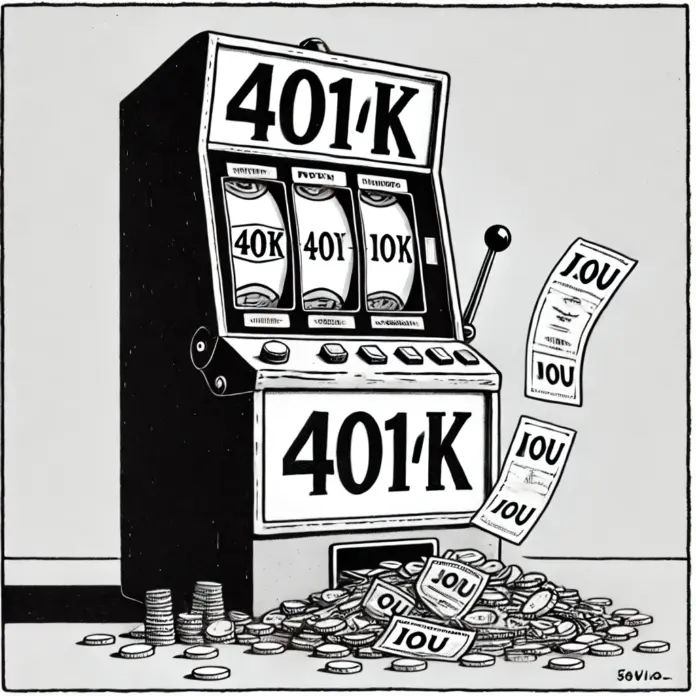

A 401(k) sounds great on paper: pre-tax contributions, employer match, stock market growth. But the fine print’s brutal. Your money’s frozen until 59½—touch it early, and you’re hit with a 10% penalty plus income taxes. At 73, required minimum distributions (RMDs) force you to withdraw, taxed as income, whether you need the cash or not. Fees—1% or more annually—nibble your gains, and market crashes can gut your balance right before you retire. Worst part? You’re deferring taxes to a future where rates could be higher. The middle class maxes out, thinking it’s safe; the elite know it’s a cage with a tax bomb waiting.

Instead, the wealthy prioritize liquidity and leverage with 401(k) alternatives. Start with real estate: rather than dumping $23,000 into your 401(k), use $15,000 as a down payment on a $75,000 rental property. Tenants cover the mortgage, you pocket $500 a month in cash flow, and the property appreciates. Need cash? Refinance or sell—no penalties. One client bought a duplex with $20,000 down, now pulls $1,200 monthly passive, and can tap equity anytime. Real estate offers tax breaks—deduct interest, depreciation—that a 401(k) can’t match, and you’re not waiting decades to see your money.

Another play: indexed universal life (IUL). Fund an IUL, and your cash grows tax-deferred, tied to market indexes without the downside risk. Borrow against it tax-free anytime—no age limits, no penalties—and keep your cash compounding. A guy I know allocated $20,000 yearly to an IUL, borrowed $40,000 for a business venture, and his cash value kept growing. The death benefit passes tax-free to heirs, unlike your 401(k), which gets taxed in your estate. IULs have no contribution caps or RMDs, scaling with your ambition, not IRS rules.

Private investments are another elite move. Instead of a 401(k)’s stock market roulette, allocate funds to private lending or equity deals. Loan $50,000 to a real estate flipper at 10%, and you’re banking $5,000 a year, no waiting till 60. Or invest in a private business—say, a $30,000 stake in a startup or franchise. One client’s $25,000 in a car wash now nets $7,000 yearly passive. These aren’t retail products; they’re high-return plays with tax advantages, like deductions or deferred gains, that beat 401(k) returns stuck at 7% before fees.

But alternatives aren’t a free ride. Real estate can slump, IULs need careful management, and private deals carry risk. You need a plan—market research, a financial pro, maybe a lawyer for LLCs or trusts to shield gains. The payoff? Wealth you control, not a 401(k) slot machine spitting IOUs. The rich don’t lock their money in cages; they build streams that flow now and later. One client shifted $100,000 from his 401(k) to a real estate syndication, now earning 8% annually with tax breaks, while his old plan bled fees. You can too. Grab a free wealth leverage checkup, run your numbers, and see where your 401(k)’s choking your potential. Stop maxing out—start building wealth that’s yours to use.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.