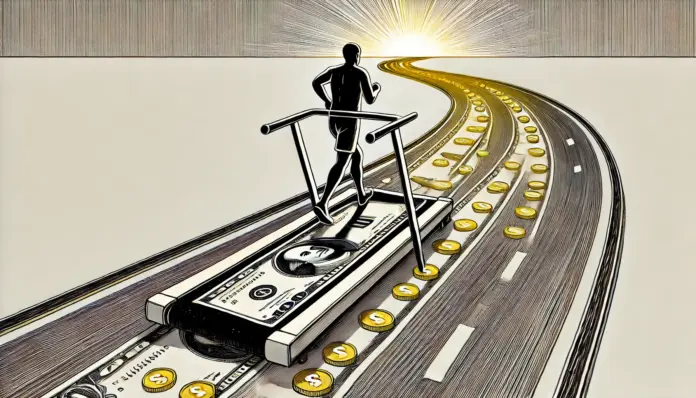

You’re sprinting on the hustle treadmill—80-hour weeks, side gigs, no sleep—convinced that grinding harder will make you rich. Spoiler: it won’t. Hustle culture’s a lie, a shiny trap that keeps you trading time for pennies while your net worth flatlines. The wealthy don’t outwork everyone; they outthink them, leveraging assets, tax-smart plays, and systems that churn wealth without burnout. Wealth over hustle is the pivot you need—ditch the grind, embrace leveraged thinking, and watch your money grow while you breathe. Here’s why hustle’s killing your net worth and how to break free.

Hustle’s a hamster wheel. You’re piling on hours, chasing paychecks or clients, but there’s a hard cap—24 hours in a day and your sanity. That W-2 job or freelance hustle gets taxed to death, sometimes 40%, before you see a dime. You’re left with crumbs, no time, and a body screaming for rest. Meanwhile, the rich are sipping coffee, their money working via passive income streams—real estate, business equity, or tax-advantaged vehicles. One guy I know works 20 hours a week because his rental properties throw off $8,000 a month. He didn’t hustle harder; he invested smarter. Hustle keeps you busy; leverage makes you rich.

Leveraged thinking means owning, not doing. Take real estate: instead of grinding for a $10,000 bonus, put $20,000 down on a $100,000 rental. Tenants pay the mortgage, you pocket cash flow, and the property appreciates. Need cash? Tap equity, no penalties. A client started with one unit, leveraged it into a portfolio, and now nets $15,000 monthly without a 9-to-5. Or consider business equity—buy into a franchise or private company where systems, not your sweat, drive profits. One woman invested $40,000 in a laundromat, hired a manager, and pulls $12,000 a year passive. Hustle’s trading time for money; leverage is trading money for freedom.

The tax game’s where hustle really chokes. Your hard-earned income gets slammed—income tax, Social Security, Medicare—while the wealthy play chess with the IRS. They allocate to tax-advantaged growth like real estate, deducting interest and depreciation, or use indexed universal life (IUL) to grow cash tax-deferred and borrow tax-free. One sharp move: a guy funded an IUL with $30,000 yearly, borrowed $50,000 for a business deal, and kept his cash compounding. His hustle income would’ve been taxed at 37%; his IUL play? Zero. Leverage isn’t just about money—it’s about keeping more of it.

But leverage isn’t a shortcut. Bad deals, market dips, or sloppy planning can sting. You need research—study markets, vet partners—and a team: a financial pro for tax-smart strategies, maybe a lawyer for LLCs or trusts. The payoff? Wealth that scales without your constant grind. Hustle culture glorifies exhaustion; leveraged thinking builds systems. One client ditched freelancing, allocated $60,000 to a real estate syndication, and now earns $6,000 a year passive, with time to live. Hustle’s a treadmill to nowhere; leverage is a highway to wealth.

The pivot starts with a mindset shift. Stop worshipping hard work and start valuing smart work. List your hustle habits—overtime, endless gigs—and replace one with a leveraged move. Read about real estate syndications, explore IULs, or talk to a mentor who’s built passive income. Small steps rewire your brain from “work harder” to “think richer.” The wealthy don’t run faster; they build machines that run for them. You can too. There’s a free wealth leverage checkup out there—grab it, run your numbers, and see where hustle’s draining you. Stop letting grind kill your net worth. Pivot to wealth over hustle, and let your money outwork you.

Louie Molina is the host and architect of The Empresario. Drawing from years of financial design and strategic consulting, he created The Empresario Reserve as the ultimate repositioning strategy — a system that turns financial instruments into instruments of control.